Trump administration announces phased auto tariff relief to reshape U.S. manufacturing amid political backlash

By willowt // 2025-04-30

Tweet

Share

Copy

- The Trump administration announced a tariff relief plan requiring foreign automakers to use 85% domestic/U.S.-compliant parts in U.S.-assembled vehicles to qualify for exemptions. Incentives include phased reductions in tariff offsets (3.75% of car value in Year One, dropping to 2.5% in Year Two).

- The policy seeks to shift manufacturing to the U.S. by penalizing foreign automakers while offering transitional support for domestic parts sourcing. Trump’s broader goal: Reduce reliance on China and strengthen USMCA trade terms with Canada and Mexico.

- Democrats, including Rep. Shri Thanedar, criticized the plan as executive overreach, filing impeachment articles. Critics warn of inflation risks and constitutional challenges, while the White House dismisses these concerns.

- Analysts fear price hikes (up to $6,000 per vehicle) and potential retaliation from trade partners, similar to past tariff conflicts (e.g., 2018 steel levies). Skepticism remains over how quickly automakers can reshore production given global supply chain complexities.

- The policy is a high-stakes gamble: aimed at boosting U.S. manufacturing but risks trade wars, inflation and political strife. Success depends on automakers’ ability to quickly localize supply chains, a challenge exacerbated by bipartisan opposition and logistical hurdles.

Policy details: Tariff relief for U.S.-built cars, but stricter rules for foreign automakers

Lutnick’s announcement clarifies that tariffs will apply to foreign automakers producing vehicles in the U.S., while also offering phased incentives to transition to fully domestic parts sourcing. The Commerce Department mandates that U.S.-assembled cars must include 85% domestic or USMCA-compliant content to avoid tariffs in the first year, which rises to 90% in the second year. Foreign automakers will receive offsets equivalent to 3.75% of a car’s value in the first year (reducing to 2.5% in Year Two) to counteract tariffs on imported parts. “This deal rewards companies manufacturing domestically while giving automakers runway to shift supply chains,” Lutnick told the Wall Street Journal, emphasizing the policy’s dual goals: shielding U.S. industries and pressuring allies like Canada and Mexico to respect bilateral trade terms. Ford CEO Jim Farley praised the plan as a “mitigation step,” though analysts like Morgan Stanley warned of potential $6,000 price hikes per vehicle.Political context: Trade strategy sparks Democrat backlash and inflation fears

The tariff adjustments come amid intensifying partisan conflict and economic uncertainty. Less than 24 hours after the policy’s unveiling, Michigan Democratic Representative Shri Thanedar filed impeachment articles accusing Trump of undermining democracy through executive overreach. Thanedar’s move follows years of Democratic accusations that Trump’s tariffs destabilize consumer markets—a charge the White House disputes. Lutnick, a vocal tariff advocate, argued earlier this year during Senate confirmation hearings that tariffs are essential to “redress trade imbalances,” dismissing inflation concerns as “nonsense.” Yet the administration’s approach risks angering global trading partners and further inflaming supply chain bottlenecks. Meanwhile, auto executives have privately acknowledged that reshoring parts manufacturing—a core Trump goal—could take years, raising doubts about the plan’s short-term efficacy.Economic implications: Trade-offs between manufacturing revival and rising costs

Critics argue the tariffs’ real-world impact mirrors historical trade policy pitfalls. Past U.S. protectionism, such as 1930s Smoot-Hawley tariffs during the Great Depression, backfired by worsening global economic isolation. Similarly, Trump’s 2018 steel and aluminum levies sparked retaliatory measures from Canada and the EU. The current plan seeks to avoid similar backlash by exempting USMCA-compliant goods and offering flexibility. However, a retroactive rebate mechanism for earlier tariffs—which would reimburse automakers for duties paid since March—remains logistically and financially unclear. Treasury Secretary Scott Bessent called the offsets a “path to domestic job creation,” but the 25% China-related tariffs Trump retains could still stifle global trade.Tariffs as a double-edged sword for Trump’s economic vision

As Trump pivots to reshoring supply chains ahead of his 100-day rally in Michigan, his auto tariff adjustments highlight both ambition and risk. The strategy aims to fulfill pledges on manufacturing revival and national security, but its success hinges on automakers’ ability to swiftly localize production—a challenge exacerbated by globalized supply networks. With Democrats poised to frame the tariffs as economically reckless and legally overreaching, the administration faces a precarious balancing act: maintaining voter support through short-term industry boosts while navigating prolonged trade wars. For now, the policy remains a gamble on reshaping U.S. industry—one fraught with partisan fissures and unresolved economic uncertainties. Follow-up reporting will explore grassroots reactions to auto price hikes and geopolitical fallout from European trade partners. Sources for this article include: ZeroHedge.com WSJ.com Bloomberg.comTweet

Share

Copy

Tagged Under:

economy market crash Trump big government finance risk geopolitics inflation pensions supply chain government debt tariffs trade war Lutnick

You Might Also Like

Trump cracks down on sanctuary cities as leftist mayors protect criminal illegal aliens

By Cassie B. // Share

Schiff on Kitco News: The dollar bubble just burst

By News Editors // Share

Putin announces three-day ceasefire in Ukraine for Victory Day, raising skepticism and hope

By Belle Carter // Share

UPS slashes 20,000 jobs, shuts facilities in $3.5B cost-cutting move after Amazon split

By Cassie B. // Share

Grassroots health revolution gains momentum as MAHA movement expands beyond RFK Jr.

By Willow Tohi // Share

Recent News

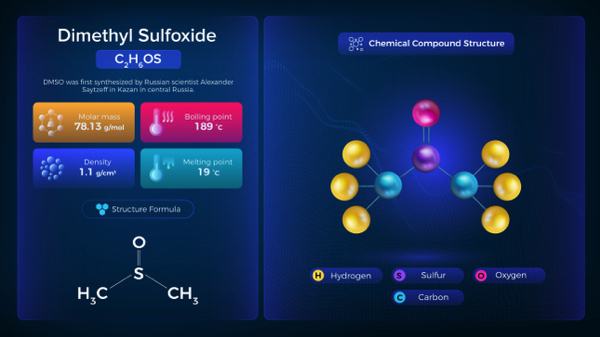

A comprehensive look at DMSO's potential in cancer treatment

By ramontomeydw // Share

Dill: An ancient superfood with modern healing powers

By avagrace // Share