Housing relief in sight as foreign buyers retreat, deportations rise and Airbnb pulls back

By willowt // 2025-04-22

Tweet

Share

Copy

- Political tensions, Trump’s tariffs, a weak Canadian dollar and Canada’s own foreign-buyer ban led to a mass exodus of Canadian investors, who previously accounted for 13% of foreign home purchases. This reduced competition in the U.S. housing market.

- Under Trump, deportations surged (100,000+ since January) and illegal crossings dropped 94%, reducing housing demand from migrants. Realtors predict rents could fall by 15% by year-end, though critics warn of economic instability from mass deportations.

- High costs and regulatory pressures are pushing owners to convert or sell 2.4 million short-term rentals, with 500,000 expected to exit the market by 2026 — potentially easing the housing shortage.

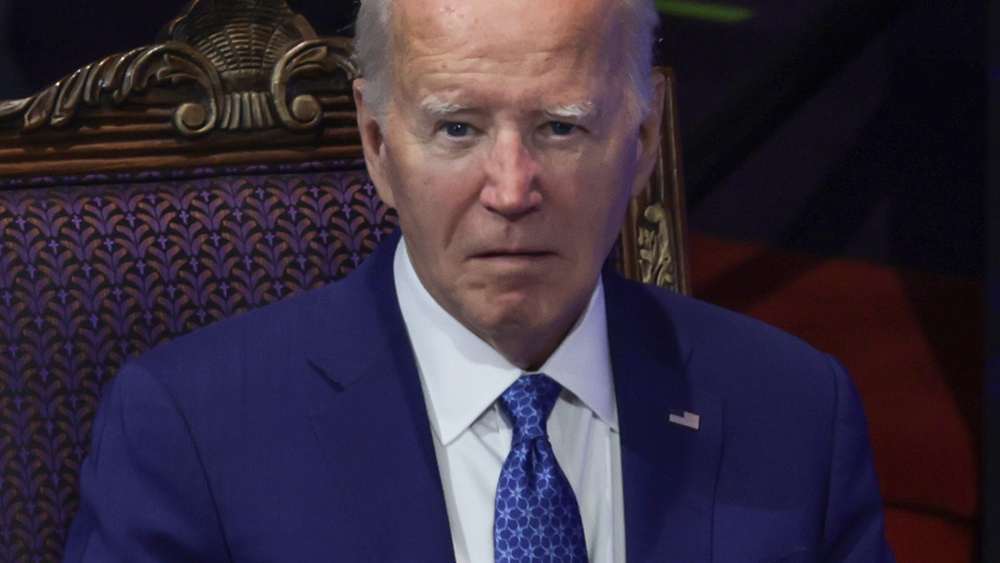

- Trump’s hardline immigration stance contrasts sharply with Biden’s policies, which saw cartel profits soar from smuggling. Meanwhile, Canada’s housing crisis and political uncertainty accelerated its residents’ U.S. property sales.

Canadians cash out amid uncertainty and political tensions

The largest foreign presence in U.S. real estate — Canadian buyers—has exited en masse, driven by a perfect storm of economic and political factors. Canadians, who accounted for 13% of foreign home purchases in 2024, are fleeing U.S. properties amid President Trump’s 25% tariffs on Canadian goods and rhetoric suggesting annexation of their country. “The key word is ‘uncertainty,’” said Catherine Spino, a Florida realtor, noting a doubling of Canadian sellers in early 2025 compared to previous years. Nathalie Mancuso, a Montreal-based teacher, sold her Florida condo amid fears Trump’s policies would escalate anti-Canadian sentiment. “We were scared of what might happen,” she said. Similar stories emerged nationwide: Retiree Garry Liboiron cited tariffs as accelerating his sale of a Phoenix home, while David Altro, a cross-border legal expert, reported a tenfold rise in Canadian clients seeking to sell. The Canadian exodus is further fueled by a 22-year low in the Canadian dollar, which has made U.S. property taxes and HOA fees prohibitively expensive. Meanwhile, Canada’s own crackdown on foreign buyers — banning purchases except in sparsely populated areas since 2023 — has severed a critical two-way demand chain.Deportations and policy shifts cool rental demand

The Trump administration’s hardline immigration policies have also shifted market dynamics. Since January, U.S. Immigration and Customs Enforcement (ICE) has arrested 113,000 migrants and deported over 100,000, slashing illegal border crossings to 7,000 in March — a 94% drop from Biden-era levels. Agencies attribute this to strict enforcement, including charging migrants criminally and sidestepping court delays, such as using the Alien Enemies Act to deport gang members without hearings. ICE officials boast that the administration is “doing what he was voted in to do” to curb illegal immigration, a marked contrast to the prior White House’s open-door approach. These actions, combined with self-deportations by migrants fearing repercussions under Trump’s “CBP One App” system, have already eased rental pressures. While critics argue displacing 17 million – 20 million undocumented residents would destabilize sectors like construction, realtors note fewer migrants in housing markets could lower rents by 15% by year’s end. Historically, U.S. border policies have oscillated between liberal and strict, but Trump’s return has reignited debates over how enforcement impacts economies. Under Biden, Mexican cartel income from smuggling surged to $13 billion annually — 2,500% higher than in 2018 — as porous borders enabled mass crossings, yet cartel profits may now contract as fewer migrants risk crossing under heightened scrutiny.Airbnb’s decline frees up 2.4 million properties

The fading hotel-sharing craze is another wildcard in housing markets. A peak of 2.4 million U.S. homes remain listed as Airbnbs, but high property taxes, stagnant tourism and insurers’ reluctance to cover such properties have driven many owners to convert them into traditional rentals or sell. Analysts predict half a million short-term rentals will exit the market by 2026, injecting desperately needed supply into the housing crisis. While Airbnb’s retreat could pressure hospitality businesses and local economies, it’s a net positive for families struggling to afford homes. “Supply must increase to offset demand,” argues Tyler Durden, whose analysis notes that soaring fixed costs like housing and utilities erode disposable income significantly. For example, renters now pay 60% more annually than in 2020 in many areas, squeezing budgets and stifling consumer spending.Policy and currency shifts shape the market

The current trends recall the pendulum of American immigration politics. Biden’s 2021 openness to asylum seekers and rumored amnesty proposals (estimated by some outlets at 18 million beneficiaries) contrasted sharply with Trump’s border wall rhetoric and immediate deportation tactics. Meanwhile, Canada’s own housing crisis, exacerbated by former Prime Minister Trudeau’s policies, has driven its citizens to sell second homes abroad. Experts caution that lasting relief depends on sustained policy and economic stability. Canada’s flight from U.S. properties could reverse if tariffs ease, and critics warn that overzealous enforcement may deter legal immigration or alienate key trade partners. Yet, for now, Americans increasingly see hope in a market once deemed untouchable. Sources include: ZeroHedge.com WSJ.com NYPost.comTweet

Share

Copy

Tagged Under:

market crash Open Borders Trump border security Canada big government migrants risk money supply bubble Housing Market deportations progress invasion usa tariffs trade wars economic riot finance riot foreign buyers political tensions policy shifts

You Might Also Like

Economic fallout and strategic stakes mount as U.S.-China trade tensions escalate

By Willow Tohi // Share

Trump administration considers ABANDONING Ukraine peace talks if no progress is made

By Ramon Tomey // Share

Trump targets China’s shipping dominance with phased port fees

By Cassie B. // Share

Science reshapes autism care by looking beyond the brain

By Olivia Cook // Share

POLL: 81% of Americans fear job loss amid surging layoffs and economic uncertainty

By Laura Harris // Share

Recent News

FDA to remove Pharma reps from advisory panels, aiming to restore public trust

By ljdevon // Share

Pope Francis dies at 88: A pontiff of global compassion and fracturing tradition

By willowt // Share